In the ever-evolving world of cryptocurrencies, Stellar Lumens (XLM) stands out as a powerhouse focused on bridging traditional finance and blockchain’s future. As global remittance demand surges and institutional adoption grows, analysts are making bold forecasts—some predicting XLM could reach $1–$6 by 2030, a staggering leap from today’s price.

🌍 What Is Stellar (XLM), and Why Does It Matter?

Born in 2014 via founders Jed McCaleb and Joyce Kim, Stellar operates as a decentralized payment network aimed at simplifying cross-border transfers. It offers a fast, low-cost method to exchange currencies and assets, powered by its native token, XLM. Over the years, Stellar has partnered with institutions like IBM, Deloitte, and the Federal Reserve’s FedNow framework.

Today, it’s more than a blockchain; it’s a payments infrastructure in motion, with real-world applications and growing institutional interest.

💹 Historical Price Snapshot: Learn from the Past

XLM’s price history reads like a crypto classic—massive surges and sharp corrections. Initial rallies in 2017 and 2021 saw prices near $0.90, followed by pullbacks to $0.05–$0.10 . January 2025 brought renewed momentum, as XLM pushed toward $0.48 before stabilizing above $0.26.

These patterns underscore the impact of broader crypto cycles on XLM’s trajectory.

📈 What Analysts Are Saying: Forecasts for 2025–2030

| Year | Conservative Range | Average Forecast | Bullish Peak | Source |

|---|---|---|---|---|

| 2025 | $0.258–$0.394 | $0.316 | $0.51 | Benzinga, Kraken, DigitalCoinPrice |

| $0.23–$0.88 | ~$0.55 | $1.41 | InvestingHaven | |

| 2026 | $0.17–$0.201 | $0.155 | ~$0.76 | Benzinga, DigitalCoinPrice |

| $0.66–$1.41 | ~$1.0 | $1.44 | InvestingHaven | |

| 2027–28 | – | – | $1.14–$3.36 | Cryptopolitan, CoinStats |

| 2030 | $0.326–$0.632 | ~$0.345 | $6.19 | CoinCodex, Binance, CoinStats |

🔍 How Do These Predictions Compare?

- Short-Term (2025): Most forecasts cluster between $0.26 and $0.40, reflecting a cautiously bullish view backed by technicals and renewed market interest.

- Mid-Term (2026–2027): Predictions bifurcate—some anticipate moderate growth to $0.70–$1, while others see a possible surge to $1.40+ boosted by institutional adoption.

- Long-Term (2030): Estimates diverge sharply:

- Conservative algorithms see $0.63,

- Market-friendly models edge toward $1–$1.30,

- Hyperbullish views imagine XLM reaching $4–$6, driven by global use and token utility.

🔧 What’s Fueling These Forecasts?

- Institutional and Real-World Adoption

Stellar’s integration with payment rails like FedNow and partnerships with banks give XLM a strong utility foundation. - Cross-Border Remittances

As global remittance demand grows, Stellar’s low-fee, blockchain-based solutions could accelerate XLM uptake. - Macro Crypto Cycles

Bull markets typically amplify altcoin performance, and XLM is well-positioned to ride the wave. - Technical Patterns

Analysts highlight bullish formations—cup-and-handle, triangle breakouts—pointing to potential upside momentum.

⚠️ Risks That Could Derail These Predictions

- Volatility & Market Downturns: Broad crypto market corrections could pull XLM substantially lower.

- Competitive Pressure: Rival protocols like Ripple or new CBDCs may claim market share.

- Execution Risks: Stellar’s plans hinge on smooth adoption; delay or poor execution could stall momentum.

- Regulatory Hurdles: Global crypto regulation could influence institutional appetite and utility.

📌 Mighty Milestones to Monitor

- Completion of key partnerships with banks and financial institutions.

- Breakover of $0.47–$0.50 resistance, which could unlock more bullish technical waves flitpay.comfxleaders.com.

- Institutional fund flows into crypto via XLM-linked projects.

- Regulation clarity, especially around cross-border payment systems.

👤 What This Means for You

- Traders: Watch momentum signs above $0.30, and consider profits if XLM outperforms in altcoin rallies.

- Long-Term Investors: Diversified portfolios could benefit from medium growth scenarios—especially if XLM penetrates global payments.

- Conservative Investors: Stick to measured exposure, omitting from funds if volatility is too high.

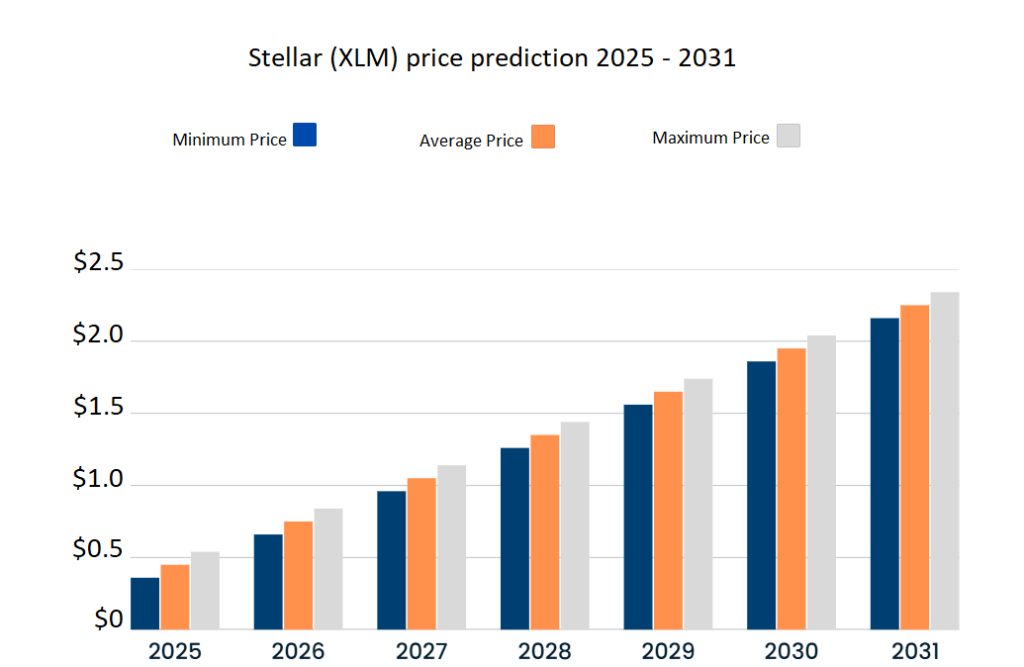

📹 Visual Breakdown

(Check out visuals above from Cryptopolitan, FXLeaders, and 99Bitcoins. Momentum, candle patterns, and price cycles make Stellar’s story clear and compelling!)

🔭 Final Verdict

Stellar’s trajectory hinges on real-world alliances and market sentiment. With a foundation built on remittance and payment infrastructure, it offers Bulls a concrete use case in a volatile space. Conservative models see growth to $0.40–$0.60 by 2025–2030, while optimistic forecasts push XLM into the $1–$6 range—a remarkable long-term target, but contingent on execution and market cycles.

XLM is no mere meme—it’s a utility play backed by partnerships, technology, and global finance trends. How it unfolds depends on policy, adoption, and broader crypto tides. Holders and watchers should stay alert to institutional moves, breakouts, and macroeconomic signals.

Disclaimer: This article is for educational and informational purposes only. Cryptocurrency investing carries significant risk—please do your own research or consult a financial advisor before making any investment decisions.