In the fast-moving realm of cryptocurrencies, Cardano (ADA) continues to intrigue as investors and analysts debate its future trajectory. With its robust proof-of-stake framework, environmentally friendly operation, and growing ecosystem, Cardano stands as a major contender among blockchain platforms. But what can its price journey look like in the coming years? This article unpacks the predictions—ranging from cautious to wildly optimistic—and explores the driving forces and risks behind them.

From Humble Beginnings to Tech Powerhouse

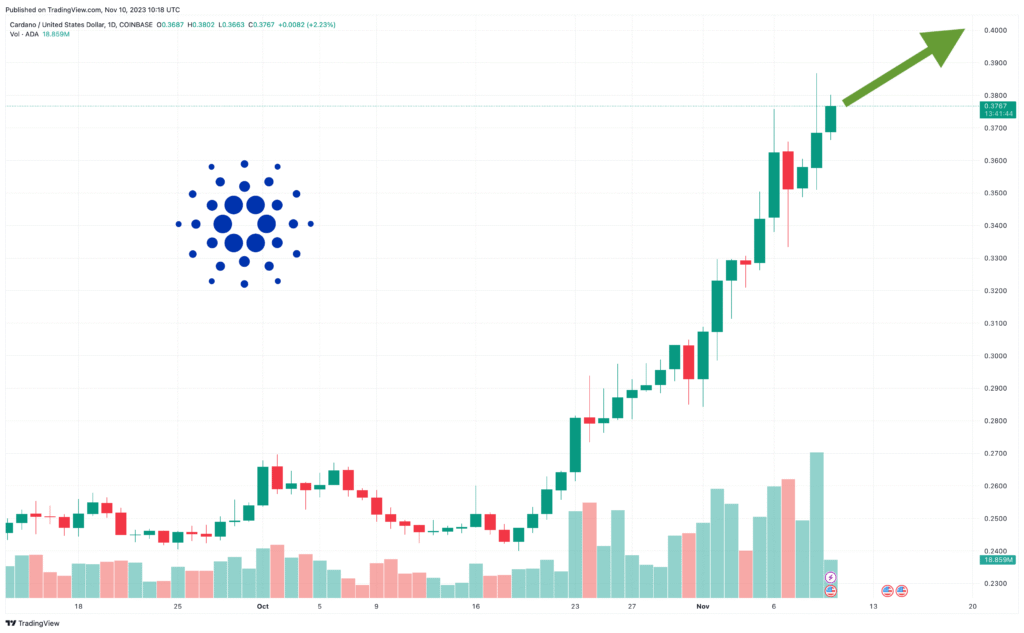

Launched in 2017, Cardano initially traded at pennies, reaching nearly $1.40 in early 2018. A steep decline followed, dropping close to $0.02 during the subsequent bear market axi.group. Dormant for some time, its value surged in 2021, propelled by the adoption of smart contracts via the Alonzo upgrade. ADA reached an all-time high of $3.20 before tumbling again to around $0.22.

Since late 2023, ADA has maintained a relatively steady range between $0.40 and $0.80, reflecting a maturing crypto landscape where volatility is dampening even among top-tier assets.

What Analysts Are Predicting

Conservative Outlooks (2025–2026)

- Changelly anticipates ADA averaging around $0.71 mid-2025, fluctuating between $0.62 and $0.74—a cautious near-term view.

- Benzinga, known for moderate projections, predicts ADA could average $0.945, with potential highs of $1.38 by 2025.

- ZebPay India estimates a 2025 price range from $0.80 to $1.25, tapering slightly through 2026 to $1.10 max.

Moderately Bullish (2025–2027)

- CoinStats gives a bold prediction of $1.40 in 2025 and as much as $10.32 by 2030.

- Investing Haven forecasts ADA between $0.66 and $1.88 in 2025, potentially pushing to $2.36. In 2026, their optimism grows: between $1.25 and $3.03.

- FastBull goes even further, suggesting ADA could hit $3–$4.50 by the end of 2025 if adoption scales.

Wild Card (2030 and Beyond)

- Some long-range forecasts—including from Changelly and Coinpedia—project ADA reaching $5.50 to $6.60 by 2030 changelly.com+5tokenmetrics.com+599bitcoins.com+5. In the most optimistic scenario—assuming Cardano achieves mass adoption and institutional integration—the ceiling extends to $10+, as suggested by CoinStats.

Key Drivers Fueling Forecasts

- Continued Protocol Upgrades

The 2025 “Plomin” hard fork completes Cardano’s Voltaire stage, ushering in full decentralization, on-chain governance, and treasury funding. This milestone boosts investor confidence. - Expanding Ecosystem Adoption

Growth in DeFi, NFTs, domain-specific chains, and sidechains like Midnight—all built on EUTXO architecture—enhances Cardano’s utility and attractiveness to developers and institutions. - Environmental and Institutional Appeal

Cardano’s lightweight proof-of-stake is lauded for low energy use, positioning it favorably for ESG-conscious investors. Backed by peer-reviewed science and formal verification, it appeals to institutions wary of energy-intensive assets . - Macro Market Themes

A bullish crypto reawakening, driven by Bitcoin halving cycles and regulatory clarity (e.g., ETF approvals), could lift ADA alongside broader altcoin gains.

Risks Tempering Growth Expectations

- Regulatory Uncertainty: Classifications like the SEC labeling ADA as a security complicate US exchange listings and could dent investor sentiment.

- Competitive Landscape: ETH 2.0, Solana, and others offer high-throughput environments that compete for developer attention and capital.

- Macro Volatility: A global economic downturn or tighter monetary policy could diminish speculative appetite, slowing gains.

- Execution Challenges: Delays in network upgrades or low dApp adoption may undermine bullish market forecasts.

Year-by-Year Outlook

| Year | Conservative Range | Bullish Scenario | Extreme Bull Case |

|---|---|---|---|

| 2025 | $0.62–$1.25 | $1.40–$3.00 (driven by adoption) | $3.00–$4.50 (FastBull-Revolutionary) |

| 2026 | $0.72–$1.36 | $1.25–$3.03 (Investing Haven) | $5.00–$7.00 (FastBull upside) |

| 2027–2029 | $1.5–$4.5 | $3.9–$12.00 (mass adoption) | — |

| 2030 | $5.50–$6.60 (Changelly) | $5–$10+ (CoinStats/TokenMetrics) | $10+ (CoinStats) |

What Should Investors Watch?

1. Governance Milestones – “Plomin” in 2025 could increase on-chain voting and funding; success may catalyze price growth.

2. Network Activity – Tracking DeFi, NFT, DAO metrics on Cardano will reveal whether developers and users are truly engaging.

3. Technical Signals – Persistent resistance above $0.70 often precedes further upside; MACD/RSI trends around $0.90–$1.00 are critical .

4. Regulatory Signals – Favorable actions like ETF approvals or SEC clarity could unlock new capital entry.

5. Competitive Moves – Strategic partnerships or launch of partner sidechains like “Midnight” signal widening scope.

Final Verdict

Cardano’s journey reflects growth, resilience, and evolving maturity. Unlike its early rollercoaster ride, current predictions share a consensus: ADA is unlikely to revert to sub-$1 territory indefinitely. Conservative forecasts point to $0.60–$1.40 by 2025–2026, while bullish models envision $3+ if ecosystem adoption picks up and leadership holds firm. Long-term projections hint at $5–$10+ by 2030 in a best-case scenario.

For cautious investors, ADA offers a measured stepping stone into crypto diversification—especially if snapshot dips near $0.70–$0.80 appear. For risk-tolerant speculators, the narrative of blockchain scalability, governance token economics, and staking yield offers a chance to ride explosive gains.

Ultimately, Cardano’s future hinges on execution—governance delivery, developer activity, and regulatory clarity. Investors should stay tuned to these signals, weigh their risk appetite, and monitor macro themes shaping crypto sentiment.

Disclaimer: This article is for educational purposes only. Cryptocurrency carries significant risk. Always conduct thorough research and consult professionals before making investment decisions.