🔍 What’s Whiterock (WHITE)? – A Refreshing Overview

Whiterock (ticker WHITE) is carving a niche in blockchain by bridging real-world assets—like stocks, bonds, property, and derivatives—with decentralized finance (DeFi). Its goal? Tokenize economic rights to traditional financial instruments for seamless, on-chain ownership and trading.

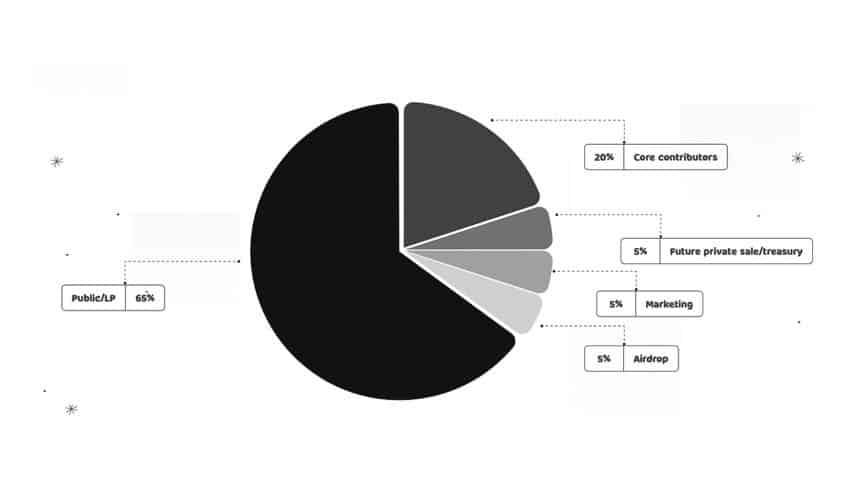

- Tokenomics:

- Max supply: 1 trillion WHITE

- Circulating: ~650 billion (~65%)

- Genesis: Born with institutional backing—partners include StoneX, First Citizens, and even BlackRock in pilot stages.

- Core innovation: USDX stablecoin, pegged to USD with yields from U.S. Treasuries—a refreshing twist on DeFi yield generation.

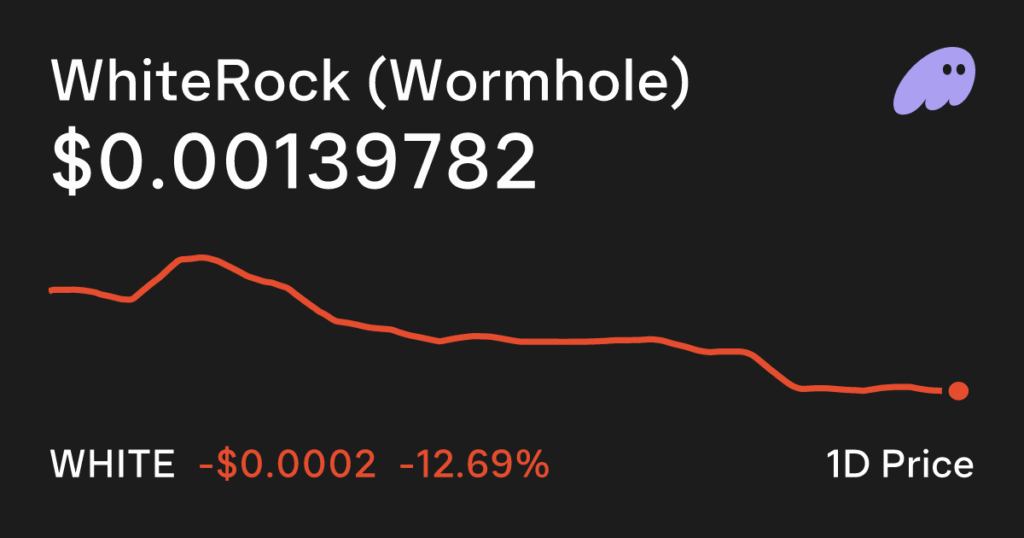

📊 Live Snapshot: Where Does WHITE Stand Today?

As of June 8, 2025:

- Price: $0.00139, up ~17% last 24 hrs, ~27% over the week gov.capital+1mexc.com+1botsfolio.com+14coingecko.com+14cryptorank.io+14

- Market Cap: Estimated between $900 million – $1 billion, trading ~2 million tokens/day cryptorank.io+1phantom.com+1

- ATH: $0.00236 (June 1); ATL: $0.000106 (Jan)

Why the surge?

Recent spikes—some over 224% in a month—hint at speculative inflows, bullish technical setups (rising wedges, symmetrical triangles), and excitement around RWA (Real-World Asset) tokenization.

🛠️ Technical Analysis: Decoding the Chart

A wave of mixed signals:

- Bullish:

- MACD bullish crossover and RSI in neutral–mildly positive zones (50–67) suggest room to rise.

- Price consolidating above key support ($0.00107–$0.00128) after rising wedge breakout.

- Cautionary signs:

- Rising wedge pattern often signals reversal; short-term dips could re-test $0.00083–$0.00107 support.

Bottom line: Indicators hint at a pause or retrace before another leg up—ideal for savvy traders eyeing lower-entry points.

🧠 Expert and Algorithmic Forecasts

Short-to-Mid Forecast (2025):

- CoinCodex: Range $0.00098–$0.001403, average ~$0.001127—implying ~28% upside by summer coincodex.com.

- Coindataflow: Projected high $0.00236 by year-end (≈+70%) but warns of 6–10% monthly dips before that.

- MEXC interactive model: Slight growth into 2026, reaching ~$0.001444 (+5%) and $0.001756 by 2030 (+27%).

Longer-term Outlook (2026–2030):

- CoinCodex: 2026 range $0.001066–$0.00370 (avg $0.002238)—~160% upside coincodex.com.

- DigitalCoinPrice: Forecasts jump to $0.0033 by 2026 and possibly $0.006–$0.007 by 2030 .

- Gov.Capital: Caution—they forecast an unrealistic $0.146 by 2026 and trillion-dollar future by 2030 (extreme optimism).

📈 Summary Table: Forecast at a Glance

| Timeframe | Conservative Forecast | Bullish Outlook | Risk Notes |

|---|---|---|---|

| By Summer ’25 | $0.00098–$0.0014 (+28%) | Volatility; watch support at $0.00107 | |

| End 2025 | ~$0.00236 (+70%) | Maybe $0.004–$0.005 | Dependent on adoption and market conditions |

| 2026 | $0.0022–$0.0033 (+150–240%) | Up to $0.006 | Realistic bullish; huge predictions are speculative |

| 2030 | ~$0.00175–$0.00271 (+100–200%) | $0.006–$0.019+ | Long timeline increases uncertainty |

🌍 What Could Drive Whiterock’s Future?

- RWA Tokenization Growth

- Expansion into equities, real estate, IP, and commodities could unlock massive liquidity pools.

- Institutional Adoption

- Real-world partnership traction with StoneX, BlackRock, etc., lends legitimacy and trust.

- Regulatory & Yield Innovations

- Stablecoin yield from U.S. Treasuries (USDX) may attract risk-averse investors.

- Crypto Market Trends

- A renewed altcoin cycle and DeFi resurgence could boost speculative flows.

⚠️ What Could Slow It Down?

- Regulatory setbacks: Real-world asset tokenization remains under scrutiny.

- Macro headwinds: Global recession fears or central bank tightening could reduce speculative appetite.

- Insider selling: Token unlocks (e.g., 110 million tokens in 2027) could exert downward pressure.

- Technical resistance: Overbought signals may lead to pullbacks.

💡 Strategic Takeaways for Investors

- Long-term investor: Whiterock shows promise—especially if RWA tokenization takes off. Consider phased entry.

- Short-term trader: Monitor MACD & RSI; wait for dips near $0.0011–$0.0012 for better risk/reward.

- Diversification: Don’t bet the house—complement with other DeFi/reg-fintegration plays.

🖼️ Final Thoughts

Whiterock is more than a meme coin—it’s a serious DeFi infrastructure play. With up to $1 billion market cap, institutional partners, and a tangible bridge between real assets and crypto, it could be ahead of the curve. Forecasts range from modest (~+50%) to moonshot (+500%+), with the truth likely somewhere in between.

If you believe in tokenizing the future of finance, enter early, titrate in, and keep an eye on both on-chain fundamentals and global macro conditions.

📌 Quick FAQ

Is it too late to buy WHITE?

Not necessarily. A dip to $0.0011–$0.0012 presents a good entry—unless the broader market tanks.

Can it double or triple?

Yes—most models suggest 100–200% gains by 2026; bullish ones claim even 400–600%.

When should investors pay attention?

- Short-term: Watch for consolidation breaks and support retests ($0.00107–$0.00128).

- Long-term: Quarterly tokenomics, institutional integration, and regulatory news.

🚀 Final Verdict

Whiterock is a breakthrough DeFi experiment with real-world financial backing and technical promise. A prudent bet for those who believe tokenization is the next financial wave—especially when entered at favorable price points. Trade smart, do your own research, and prepare for both upside and volatility.

Disclaimer: This article is for educational purposes only. Cryptocurrency investing carries risk. Always do your own research.